File for VAT Return in Dubai, UAE

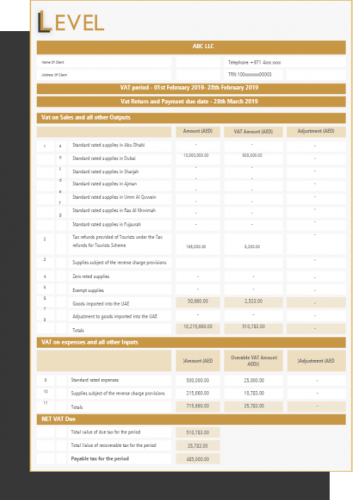

A taxable person is responsible to submit for VAT return in the UAE in a prescribed format given by the Federal Tax Authority. The VAT return discloses the due, or refundable, tax amount, for a specific tax period. As a business, you must disclose the total output payable tax, as well as the input and output credit, separately. This all sounds extremely complicated, especially for those who are not familiar with VAT processes. Luckily, Level tax agents can help you and your organization file for VAT return in record time, without any hassle or complications. You can also view the content of the VAT Return Form displayed below.

The VAT return form must be submitted to the FTA within 28 days of the tax completion period. Moreover, VAT liability must also be settled within this time frame.

Why is Filing for VAT Return with Level Important?

VAT return filing can safeguard your business by providing legal assurance and tax payment advantages, which can often help your company avoid financial loss. Level offers excellent VAT return filing services in Dubai and across the UAE. We are committed to helping your business thrive by allowing you to focus on things that matter, including running your business and maintaining relationships with clients, while we handle complicated tax procedures. Furthermore, many large UAE firms are reluctant to conduct business with organizations that are not registered for VAT.

Filing and VAT registration not only safeguards your business, but also proves to potential clients that you are serious and trustworthy. We know that each company is different, that’s why we offer tailored solutions for our clients, including guidance and support, VAT training sessions for your employees to help them understand proper tax planning, and much more. We provide both on-site training, or if you choose, we can handle everything for you so you won’t have to worry about a thing.

You can review a couple of benefits of timely and accurate VAT filing. When you file for VAT return with Level, you will:

01Reduce risks of in correct VAT filing.

03 Qualify for reimbursement of input tax.

02Avoid penalties

04 Qualify for reimbursement of tax on import of goods.

05Boost the credibility of your business.