VAT Registration in Dubai, UAE

VAT registration is a mandatory procedure of listing your business with the UAE government as active in production and sales. Level VAT consultants provide extensive guidance on VAT registration, as well as procedural formalities and documents required for the entire process. If your business is just starting out, you’re more than likely to have more than enough on your plate to be dealing with VAT registrations, so reaching out to experts can be a time-saving and stress-relieving decision. At Level, we are a team of professionals that offer extensive VAT registration services in Dubai, and we provide top-quality support and assistance for local and international businesses.

How Can I Register My Business for VAT in Dubai, UAE?

Registering for VAT is simple. Simply access the UAE Federal Tax Authority website, create an account, and register your business for VAT. You can find plenty of information about VAT on their website, as well as contact info if you want to reach them via phone. Alternatively, you can ask us to handle the entire VAT process for you and skip all the hassle.

Is VAT Registration Mandatory?

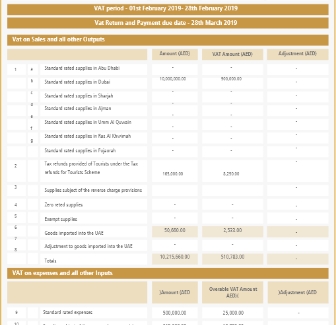

The official governmental guideline states that a company or business must register for VAT if it has an average revenue of more than AED 375,000/year. If your revenue is below this threshold, registration becomes voluntary. Even if registering for VAT in Dubai might be optional in some instances, as a business owner, you should register anyway. Registration is optional for businesses whose supplies and imports don’t exceed AED 187,500 per year.

Documents Required for VAT Registration in the UAE

Level agents can effortlessly register your business for VAT. All we need from you is a few documents to get the process started. See below the paperwork you need to be eligible for VAT registration in Dubai.

- Copy of trade license;

- Passport copy of business owner and partners;

- Copy of Emirates ID held by owner and partners;

- Memorandum of Association (MOA) of the company;

- Company contact details;

- Bank account details;

- The income statement for the last 12 months or the turnover declaration letter as provided by the FTA;

- Nature of business and activities performed.