Choose Level for VAT Implementation in Dubai, UAE

Proper VAT implementation is essential for your business. Having the ability to resolve complicated taxation issues can be very advantageous in terms of maximizing your tax position, reducing your liabilities, and improving your profit margins. Being familiar with the concepts of value-added tax can even help business owners provide a fair price for their services. The implementation of value-added tax is a complex process and consulting with reliable Dubai VAT consultants is necessary.

Level is a reputable VAT firm in the UAE that offers comprehensive taxation services to businesses, including VAT Implementation. Our services include value-added tax advisory and VAT consultancy, as well as implementation strategies. Our mission is to help our clients create an effective strategy where they can maximize their tax recovery and ensure they comply with regulations set by the government. Our clients remain our foremost priority, which is why we go the extra mile to provide the best services possible.

Why is VAT Implementation Important?

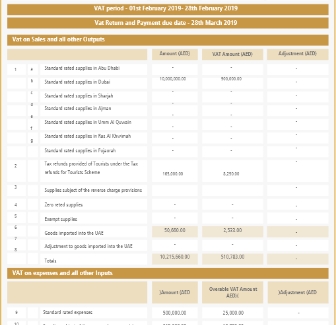

VAT implementation in Dubai allows organizations to document their income costs and any associated charges. Value add tax implementation also ensures a complete analysis of your business environment, and Level agents are equipped with extensive knowledge to help you handle every step of the way.

We can offer VAT training services, so you and your employees learn how to properly implement VAT, or we can appoint agents to do the work for you. Insightful data can be obtained once VAT is implemented, including data about your business’ profits, expenses and working capital. Furthermore, VAT implementation means constant evaluation of transactions and a better overview of your business model.

The Key Phases of VAT Implementation With Level

Implementing VAT can be a hassle for those who are not familiar with the process. A multitude of steps have to be taken in order to ensure proper functionality, which usually involves the initial assessment, technical analysis, implementation, testing, and post-implementation assistance.

01 VAT Impact Assessment: Initial assessment is drafted so we can see the positive impact VAT implementation will have on your business.

02Planning and Implementation: The VAT implementation process is initiated, with changes already happening with supply chain structures, internal management, and more.

03Testing: In the third phase, we look at your products and review them from a VAT perspective, essentially doing trial runs to find potential issues and fix them.

04 Post-Implementation: We continue to monitor and assist you with any issues you might run into, plus offer other VAT services if you’re in need.