Make Sure Your Business is Regulatory Compliant with Level VAT Accounting

In the UAE, every taxable business needs to maintain records of its books. The UAE tax law requires detailed documentation for every business, as this helps keep track of the consumption tax that is mandatory to be paid on time. Proper bookkeeping and VAT record maintenance are critical, and Level consultants provide top-notch VAT accounting services in Dubai for your convenience. We are a team of professionals who have extensive knowledge of UAE VAT laws, and can help you with a variety of services when it comes to VAT accounting, including tax calculation, reviewing of tax reports, filing, and much more.

Level Tax Agents Ensure Proper VAT Accounting in Dubai, UAE

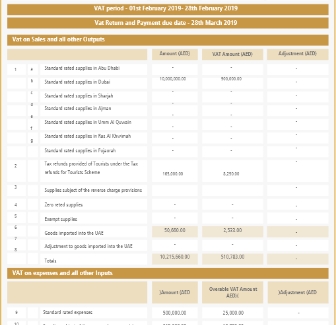

VAT accounting is a complicated process, but luckily, we are aware of all the elements and processes that need to be implemented for your organization’s proper functionality. Plus, a business must have standardized bookkeeping in order to comply with the law and avoid penalties and fines. In the UAE, there are 3 kinds of VAT rates, namely standard rate, zero rate, and exempt.

- Standard Rate VAT: This is the standard 5% rate that was initially proposed January 1st, 2018, the first time the country introduced VAT. Items taxed at a standard rate include food and beverages, electronics, automobiles, fuel, cosmetics, and more.

- Zero Rate VAT: Certain goods and services aren’t charged with VAT. These are still taxable items, but with a zero rate tax. These often include the export of goods and services, international transportation, residential buildings, certain education services, and more.

- Exempt: For goods and services under this category, VAT is not applicable. Financial services, land transactions and public transportation services, among others, are usually exempt from all VAT charges

What Are the Benefits of VAT Accounting?

For your business to operate smoothly, you need a solid financial system in place and skilled professionals to undertake VAT accounting procedures. Accuracy is key, and remaining fully compliant with the UAE law when it comes to VAT is essential for any organization.

Here are a couple of reasons why VAT accounting is important:

01It is a mandatory requirement by the UAE.

03It keeps the business flexible.

05It helps you become familiar with VAT procedures.

02It ensures easy and hassle-free tax returns.

04It can help you reduce the burden of VAT audit.

06It can enhance revenue growth.

07 It drastically decreases the risk of penalties.